Five Parts to Your FICO® Credit Scores

What Affects Your Credit Rating

The Fair Isaac Credit Organization (FICO®) score is the industry standard for determining a consumer's credit rating. Lenders and others use the FICO® credit score standard to judge a person's credit record, using a complex algorithm that involves several factors.

The Fair Isaac Credit Organization (FICO®) score is the industry standard for determining a consumer's credit rating. Lenders and others use the FICO® credit score standard to judge a person's credit record, using a complex algorithm that involves several factors.

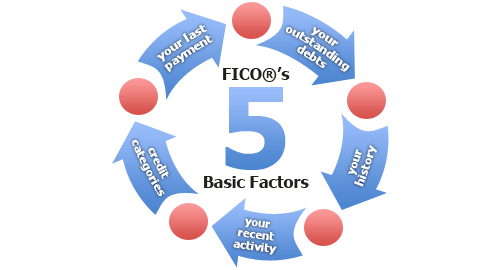

There are five basic factors that a FICO® credit score calculator takes into account when measuring your credit history:

- Your past payment practices. FICO® evaluates how you've paid previous lenders, including those offering payment plans on an ongoing basis.

- Your outstanding debts. A FICO® algorithm also considers what you currently owe against maximum credit amounts on your current lines of credit, if any.

- Your history. Another aspect of FICO® calculations is how long you've had credit. For each credit line, the longer you've had the line of credit, the more a FICO® algorithm can decipher about your payment history. A younger person will have less credit data and credit history to learn from, as will someone without ongoing credit accounts.

- Your recent activity. A FICO® credit score calculator also looks at what you've attempted to do, credit-wise, to determine how your credit-seeking activity matches your payment history. This relationship forms part of the FICO® index of calculations.

- Credit categories. FICO® also evaluates what kind of credit a person has dealt with or holds, including home-related credit (e.g., mortgages, home equity lines of credit), auto loans, utilities, or other kinds of credit situations.

These criteria form the basis for a FICO® score, but all scores are determined on a case-by-case basis. So how can you deal with or improve a FICO® score? It's a long process that starts with knowing more about all of the details of your overall financial situation. Many people take years to micromanage their accounts, attempting to repair a damaged credit score, and many find that the best solution is preventative credit maintenance.

Learning to manage your credit starts with getting informed about your credit. That means utilizing services like credit monitoring to find out what may be changing in your credit history report; those changes can have an immediate effect on your credit score.

Read More About Credit Scores

- How missed and late credit card payments affect your credit score

- Your Credit Score: How Your Credit Cards Influence It

- The Relationship between Credit Scores and Age

- Credit Scores vs. FICO VantageScores

- Why Each Credit Bureau Has Its Own Credit Score

- Medical Bills Don't Have to Ruin a Credit Score

- Chapter 7 or 13 Bankruptcy Can Affect Credit Scores

- Ordering Your Credit Score From a Credit Bureau

- What is a Bad Credit Score?

- Factors That Damage Your Credit Score

- What Is a Good Credit Score?

- Credit Score Myths

- How Credit Scores Are Calculated

- Why You Need to Know All Three Credit Scores

- What Are the Three Credit Bureaus?

- How Credit Scores Affect Insurance Premiums

- Student Habits That Kill Your Credit Score

- Store Credit Card Application Could Damage Your Credit Score

- International Credit Score

- What A Credit Card Balance Does to Credit Scores

- How a HELOC Affects Your Credit Score

- Medical Credit Score

- Your Credit Score May Be Worse Than You Think

- FICO - What is Coming in 2009

- Credit Score Ranges

- Five Parts to Your FICO Credit Score

- How Corporate Cards Affect Your Personal Credit Score

- Who Wants to Know Your Credit Score

- Credit Rating - How Your Credit Gets A Score

- Credit Line and Your Credit Score