What Is a Bad Credit Score?

Most people understand that a bad credit score is something that will make it hard for you to get credit, cost you a lot more when you can get it, and silently sabotage other important aspects of your life without you even knowing it.

Credit scores range from 300 to 850; scores of 620 or below are generally regarded as bad credit scores. However, it's important to note that what qualifies as a bad credit score is a little subjective and depends somewhat on the lender.

Most people understand that a bad credit score is something that will make it hard for you to get credit, cost you a lot more when you can get it, and silently sabotage other important aspects of your life without you even knowing it.

Credit scores range from 300 to 850; scores of 620 or below are generally regarded as bad credit scores. However, it's important to note that what qualifies as a bad credit score is a little subjective and depends somewhat on the lender.

A home mortgage is a good example of this credit score subjectivity. Federal mortgage companies Fannie Mae and Freddie Mac consider 620 and below to be bad credit scores. They'll still work with you to get a mortgage if you have a score ranging between 620 and 640, but it'll cost you more, because your credit score labels you as a greater risk for default.

Another example of mortgage subjectivity regarding bad credit scores might be the Federal Housing Administration (FHA), which focuses on helping people with limited resources get mortgages. The FHA will help people with credit scores as low as 580, so if you have a bad credit score and are shopping for a mortgage, you do have options. However, most lenders aren't so accommodating. If you have a bad credit score, they just won't work with you. To them, the risk of default that a bad credit score presents is too great to justify any profit that they might make from the loan.

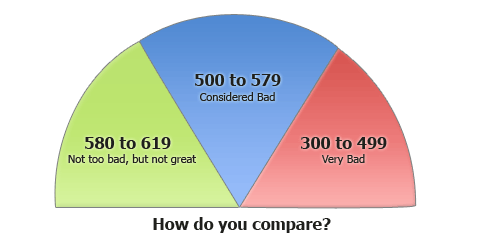

The explanations below will better illustrate what is generally accepted as a bad credit score:

- 580 to 619

Not too bad, but not great either. Scores in this range are leaning toward bad, but you can still find lenders that will work with you. However, the interest rates you get won't make you happy. - 500 to 579

FICO scores in this range are "bad" credit scores. You'll have few options for credit, and if you do find them, they'll cost you in terms of interest rates, upfront fees, and arbitrary payment schedules. - 300 to 499

Bad credit score. Very bad. Scores in this range mean that you haven't managed your credit responsibly, you've been very, very unlucky, or a combination of both. You have some work to do, and it'll take a while before things get any better.

If your credit scores fall into the bad credit score range, you're not alone. Most folks are one layoff, medical emergency, expensive car repair, divorce, identity theft incident, or other stroke of incredibly bad luck away from a bad credit score. Many fall into this category through no fault of their own, and it can happen to anyone.

As a Chinese proverb states, a thousand-mile journey begins with a single step. So if you're facing a similar journey to better manage your credit behavior, conduct some research, devise a plan, and stay the course. It may take a while, but you and your finances will be better for it.

Read More About Credit Scores

- How missed and late credit card payments affect your credit score

- Your Credit Score: How Your Credit Cards Influence It

- The Relationship between Credit Scores and Age

- Credit Scores vs. FICO VantageScores

- Why Each Credit Bureau Has Its Own Credit Score

- Medical Bills Don't Have to Ruin a Credit Score

- Chapter 7 or 13 Bankruptcy Can Affect Credit Scores

- Ordering Your Credit Score From a Credit Bureau

- What is a Bad Credit Score?

- Factors That Damage Your Credit Score

- What Is a Good Credit Score?

- Credit Score Myths

- How Credit Scores Are Calculated

- Why You Need to Know All Three Credit Scores

- What Are the Three Credit Bureaus?

- How Credit Scores Affect Insurance Premiums

- Student Habits That Kill Your Credit Score

- Store Credit Card Application Could Damage Your Credit Score

- International Credit Score

- What A Credit Card Balance Does to Credit Scores

- How a HELOC Affects Your Credit Score

- Medical Credit Score

- Your Credit Score May Be Worse Than You Think

- FICO - What is Coming in 2009

- Credit Score Ranges

- Five Parts to Your FICO Credit Score

- How Corporate Cards Affect Your Personal Credit Score

- Who Wants to Know Your Credit Score

- Credit Rating - How Your Credit Gets A Score

- Credit Line and Your Credit Score