How Credit Scores Are Calculated

Because your credit score has such a big impact on so many facets of your life, it's helpful to know how

title="credit score factors">credit scores are calculated. Not so long ago, credit score calculations were a well-kept secret; the credit reporting bureaus had full control of this aspect of our financial lives and saw no reason to share this information (i.e., there was no profit in it for them). Then the state of California, followed some time later by the federal government, made the credit bureaus divulge credit scores and reports to consumers.

Because your credit score has such a big impact on so many facets of your life, it's helpful to know how

title="credit score factors">credit scores are calculated. Not so long ago, credit score calculations were a well-kept secret; the credit reporting bureaus had full control of this aspect of our financial lives and saw no reason to share this information (i.e., there was no profit in it for them). Then the state of California, followed some time later by the federal government, made the credit bureaus divulge credit scores and reports to consumers.

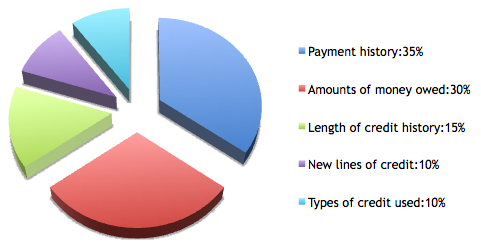

Since then, people have been able to view their credit scores. However, your credit score has a lot more significance if you know how the credit reporting agencies calculate this number. Here's a breakdown on how credit bureaus go about calculating your credit score, the factors that are considered, and the percentage that each factor is given in calculating your final score:

-

Payment history: 35%

The moral of this story is to pay your bills on time. If you can't pay on time for some reason, contact the lender to let them know why. Lenders are a very cautious group by nature and necessity, and they really like predictability. Therefore, the biggest factor is which open credit accounts you have, if you pay them on time, and — if you're late — how late the payments were.

-

Amounts of money owed: 30%

Lenders and credit bureaus look at the amount of debt you owe relative to the amount of available credit — your debt-to-credit ratio. You want that ratio to be as low as possible to benefit your credit score.

-

Length of credit history: 15%

The date that you open a line of credit has some relevance in calculating your credit score. A lender will be able to see how long you've been using credit lines, when you opened an account, what type of account you opened, and how long it's been since you had any activity on the accounts.

-

New lines of credit: 10%

This factor entails the number you accounts you've opened recently, the type of accounts, the number of recent credit inquiries (by whom and when), and when you opened the accounts. In order to keep your credit score from decreasing, try not to open several new lines of credit in a brief period of time. Lenders and credit bureaus can view that as a desperate need for money.

-

Types of credit used: 10%

For this percentage, credit bureaus look at how many different types of credit you currently use and have used in the past, such as credit cards, mortgage, car loan, retail accounts, etc.

Each of the major credit reporting bureaus — TransUnion, Equifax and Experian — use formulas like this to calculate your credit score, with slight differences in their exact formulas. Now that you know how your credit score is calculated, you can gain a better understanding of the importance of each of these factors and be on your way to a better credit score.

Read More About Credit Scores

- How missed and late credit card payments affect your credit score

- Your Credit Score: How Your Credit Cards Influence It

- The Relationship between Credit Scores and Age

- Credit Scores vs. FICO VantageScores

- Why Each Credit Bureau Has Its Own Credit Score

- Medical Bills Don't Have to Ruin a Credit Score

- Chapter 7 or 13 Bankruptcy Can Affect Credit Scores

- Ordering Your Credit Score From a Credit Bureau

- What is a Bad Credit Score?

- Factors That Damage Your Credit Score

- What Is a Good Credit Score?

- Credit Score Myths

- How Credit Scores Are Calculated

- Why You Need to Know All Three Credit Scores

- What Are the Three Credit Bureaus?

- How Credit Scores Affect Insurance Premiums

- Student Habits That Kill Your Credit Score

- Store Credit Card Application Could Damage Your Credit Score

- International Credit Score

- What A Credit Card Balance Does to Credit Scores

- How a HELOC Affects Your Credit Score

- Medical Credit Score

- Your Credit Score May Be Worse Than You Think

- FICO - What is Coming in 2009

- Credit Score Ranges

- Five Parts to Your FICO Credit Score

- How Corporate Cards Affect Your Personal Credit Score

- Who Wants to Know Your Credit Score

- Credit Rating - How Your Credit Gets A Score

- Credit Line and Your Credit Score