A Credit Score Estimator Can Be a Valuable Financial Tool

Credit scores play a large and increasingly important role in our financial decisions and opportunities these days, but the formulas that the three credit bureaus — TransUnion, Equifax, and Experian — use to create their credit scores remain hidden from us. Fortunately, credit score estimators like the FreeScore Credit Score Predictor

SM

offer you the chance to see what effect certain behaviors might have on your scores.

Credit scores play a large and increasingly important role in our financial decisions and opportunities these days, but the formulas that the three credit bureaus — TransUnion, Equifax, and Experian — use to create their credit scores remain hidden from us. Fortunately, credit score estimators like the FreeScore Credit Score Predictor

SM

offer you the chance to see what effect certain behaviors might have on your scores.

With the click of a button, the FreeScore Credit Score Predictor allows you to forecast what your credit score might be if you engaged in one or more of the activities listed below. In fact, you can combine a variety of different actions to estimate the cumulative impact they might have on your score.

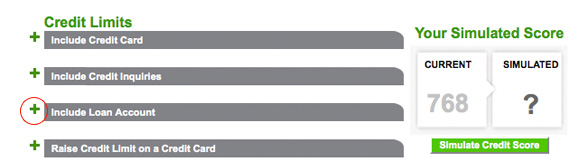

To use the FreeScore Credit Score Predictor, simply click on any of the "plus" signs to the left of the gray option bars.

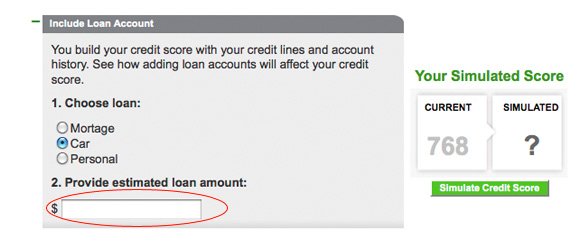

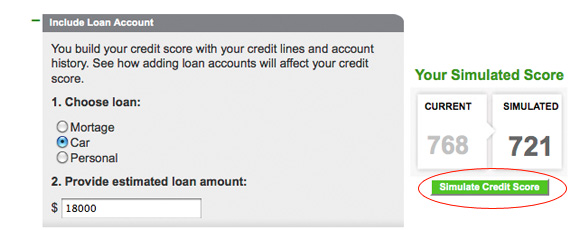

When the field below the bar expands, enter the requested information. Continue to click on different plus signs as desired to simulate additional actions on your part.

Once you've created your chosen scenario, click on the "Simulate Credit Score" button in the right column to see an estimate of how your chosen scenario might affect your current credit score.

The actions you can simulate via the FreeScore Credit Score Predictor SM include the following most common financial actions:

Increasing/Lowering Credit Limits

- Adding another credit card with a specific credit limit

- Adding a loan account (mortgage, auto, or personal) at a specific amount

- Including a specific number of the types of credit inquiries that factor into your credit score

- Raising the credit limit on a current credit card

- Transferring an existing balance to a new credit card

- Cancelling your oldest credit card account

Making On-Time or Late Payments

- Increasing, decreasing, or eliminating the balance on an existing credit card

- Letting one monthly credit account go into delinquency

- Letting all of your monthly credit accounts go into delinquency

- Maintaining a history of on-time credit payments

Public Records

- Including public records (e.g., tax liens, foreclosures, and more) in your credit score

- Letting a current account go to a collections agency

Credit scores that are based on accurate, up-to-date information can provide a fairly accurate snapshot of your risk of defaulting on a line of credit at any given time, but your scores can also change without notice, depending on your financial behavior. If you're trying to figure out a good time to apply for a mortgage, for instance, it helps to have an idea of how a specific transaction might influence your score.

That's where the credit score estimator comes into play. The credit score simulator allows you to test various "what-if" scenarios in three areas — credit limits, payment options, and public records — to see how specific activities might affect your current credit score.

It can't be stressed enough: You — and only you — have the sole power and responsibility to manage your financial behavior and, as a result, affect your credit score. Simulators like the FreeScore Credit Score Predictor can provide information about specific behaviors that can help you organize and direct your current and future financial activities. However, credit score simulators should be used for informational purposes only. To determine the right course of action for your finances, you need to take your entire financial situation into account, and credit score simulators can't do that for you.

However, in an era when credit is tight and credit scores play such a vital role, you'll want to take advantage of every opportunity to gain greater personal control of your finances, now and in the future. The FreeScore Credit Score Predictor can be a valuable tool in your financial arsenal.

Read More About Tools & Calculators

- A Credit Score Estimator Can Be a Valuable Financial Tool

- A Retirement Savings Calculator Is Your First Step Toward Your Golden Years

- Make Wiser Credit Card Payments With Our Credit Card Calculators

- Make Informed Home-Buying Decisions With Our Mortgage Loan Calculator

- Should You Buy or Lease Your Next Car?

- Timely Mortgage Payments Can Help Your Credit

- Calculate Your Car Loan Payments Before You Decide on a Car